[[{“value”:”When interest rates rise, the price of long-term assets falls. Consequently, when the Fed began raising interest rates in 2022, the value of bonds and mortgages dropped, causing significant accounting losses for banks heavily invested in these assets. Silicon Valley Bank went bust, for example, because depositors fled upon realizing it was holding lots of

The post Bailouts Forever appeared first on Marginal REVOLUTION.”}]]

When interest rates rise, the price of long-term assets falls. Consequently, when the Fed began raising interest rates in 2022, the value of bonds and mortgages dropped, causing significant accounting losses for banks heavily invested in these assets. Silicon Valley Bank went bust, for example, because depositors fled upon realizing it was holding lots of Treasury bonds.

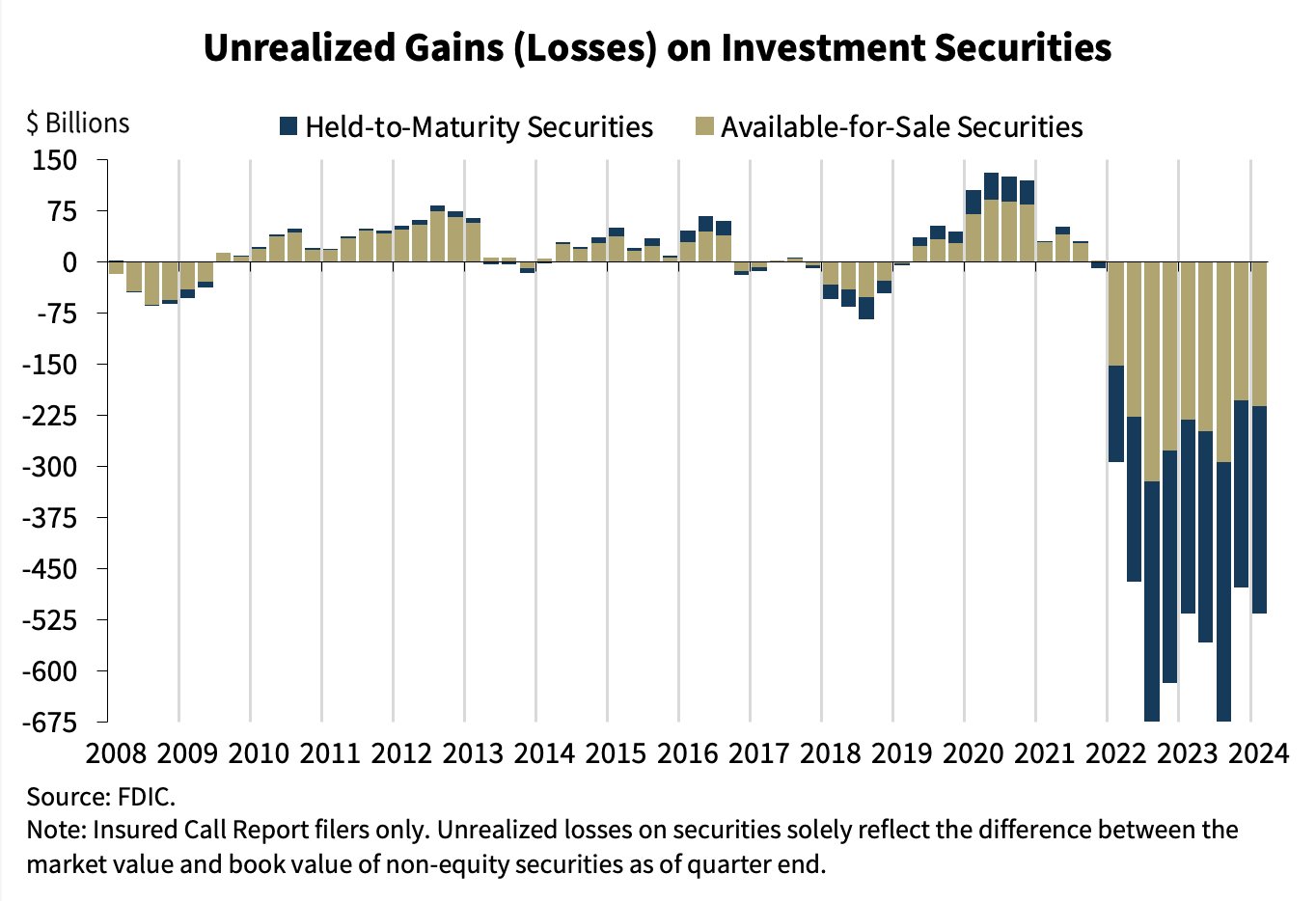

Interest rates remain high and many banks have large unrealized losses on their books. According to the latest FDIC data (see below) unrealized losses currently total $516.5 billion, far exceeding levels seen during the 2008-2009 financial crisis. Price risk is not the same as default risk and if the banks can hold onto their assets until maturity then they will be solvent. The real danger, as with SVB, is if unrealized losses are combined with a deposit run. So far that doesn’t seem to be happening but it’s well within the realm of possibility.

In other news, Hypertext has an issue devoted to Anat Admati and Martin Hellwig’s The Banker’s New Clothes. Admati and Hellwig write:

The 2010 Dodd-Frank Act in the United States promised the end of bank bailouts and “too-big-to-fail” institutions. The European Union’s 2014 legislation for dealing with banks likely to fail was claimed to provide “a framework” to “deal with banks that experience financial difficulties without either using taxpayer money or endangering financial stability.” In November 2014, Mark Carney, at the time the governor of the Bank of England and chair of the Financial Stability Board (FSB), a body of financial regulators from around the world, announced triumphantly that an agreement about new rules for the thirty largest and most complex, “globally systemic” financial institutions would prevent bailouts in the future. Many people in politics and the media believed these claims.

The post Bailouts Forever appeared first on Marginal REVOLUTION.

Current Affairs, Data Source, Economics

Leave a Reply